Protectionism

This chapter explores the concept of protectionism within the larger framework of globalisation and international trade. Protectionism refers to policies that restrict international trade to shield domestic industries from foreign competition. We'll cover different types of protectionist measures such as tariffs, quotas, currency devaluation, and government subsidies. By the end of this chapter, students will understand how countries implement protectionism and the arguments for and against it. Real-world examples, such as the US-China trade war, will help illustrate these concepts.

1. Introduction to Protectionism

Protectionism refers to measures that restrict international trade to protect a country's domestic industries from foreign competition. While free trade promotes global competition and the exchange of goods and services, protectionism aims to safeguard jobs and local businesses from being outcompeted by cheaper imports. It can take various forms, including tariffs, quotas, and subsidies.

Example: A well-known example of protectionism is the US-China trade war, where the United States imposed tariffs on Chinese goods to protect its manufacturers. This trade conflict has sparked a wider debate on the benefits and drawbacks of protectionist policies.

Key Objectives of Protectionism:

Protect Domestic Industries and Jobs – By reducing foreign competition, governments can help preserve local businesses and employment.

Prevent Dumping – Protectionism can stop foreign companies from selling products at unfairly low prices to drive out domestic competitors.

Promote Economic Independence – Protectionist policies can encourage self-sufficiency by reducing dependence on foreign imports.

Improve the Balance of Payments – By limiting imports, protectionism can help reduce a country's trade deficit.

Example: India’s protectionist policies have aimed to shield its agricultural sector from foreign competition, ensuring that local farmers are not undercut by cheaper imports.

2. Types of Protectionism

A. Tariffs

How to draw tariff diagram step by step:

A tariff is a tax placed on imported goods, making them more expensive and thus less attractive to consumers. This encourages them to buy domestically-produced goods instead.

Example: The US tariffs on Chinese steel were introduced in 2018 to protect American steel manufacturers from cheaper Chinese imports. The price of imported steel rose, which boosted the domestic industry but made products that relied on steel, like cars, more expensive.

Impact:

Diagram: A tariff increases the price of imports, which benefits domestic producers but raises prices for consumers. It also generates revenue for the government.

Effect on Markets: Tariffs can reduce competition, protect domestic industries, and generate government income, but they often lead to higher prices for consumers.

B. Quotas

A quota is a limit on the quantity of a good that can be imported. By restricting supply, quotas ensure that domestic industries face less competition from foreign products.

Example: The European Union's sugar import quotas limit the amount of sugar that can be imported from non-EU countries, thus supporting local sugar farmers.

Impact:

Quotas reduce competition, leading to higher prices for consumers and more stability for domestic producers.

Diagram: Quotas set a cap on the supply of imports, which raises prices and allows domestic producers to charge higher prices.

C. Devaluation of Currency

Devaluation involves lowering the value of a country's currency to make its exports cheaper and imports more expensive. This encourages exports and reduces imports, improving the trade balance.

Example: China’s currency devaluation in 2015 made Chinese goods more affordable on the global market, boosting exports and improving the country’s trade balance.

Impact:

Devaluation reduces the cost of exports, making them more competitive globally.

However, it increases the cost of imports, potentially leading to inflation.

Diagram: A weaker currency shifts the trade balance, encouraging exports while raising the cost of imports.

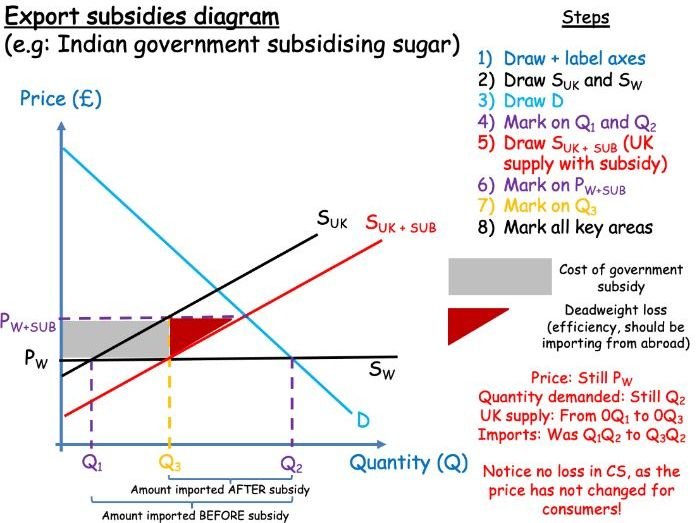

D. Government Subsidies

Governments can provide subsidies to domestic industries, lowering their production costs and making their goods cheaper on the international market.

Example: The EU’s subsidies for its agricultural sector help local farmers by reducing production costs, thus enabling them to compete with cheaper imports from countries like Brazil.

Impact:

Subsidies lower the cost of domestic production, encouraging local businesses to compete globally.

However, they can distort markets and lead to inefficiencies.

Diagram: Subsidies reduce production costs, leading to a greater supply of domestically-produced goods at lower prices.

3. How Countries Carry Out Protectionism

A. Tariffs in Action

Example: When the US imposed steel tariffs, it aimed to protect its steel industry from foreign competition. This led to higher steel prices and increased domestic production, but also higher costs for industries that rely on steel, such as car manufacturers.

Diagram: A tariff raises the price of imports, leading to increased domestic production but higher prices for consumers.

B. Quotas in Action

Example: The EU sugar quotas limit the number of sugar imports from non-EU countries. This ensures that local sugar producers have a secure market for their products, stabilizing prices in the domestic market.

Diagram: Quotas limit the supply of foreign goods, allowing domestic producers to sell at higher prices.

C. Currency Devaluation in Action

Example: When China devalued its currency in 2015, it made Chinese goods cheaper for international consumers, boosting exports. However, this also made imported goods more expensive for Chinese consumers.

Diagram: Devaluation causes the currency to weaken, increasing exports while raising the cost of imports.

D. Government Subsidies in Action

Example: The EU’s Common Agricultural Policy (CAP) provides subsidies to farmers, helping them stay competitive despite higher costs of production compared to countries with lower production costs.

Diagram: Subsidies reduce production costs, increasing the supply of domestically-produced goods.

4. Arguments for Protectionism

A. Protection of Domestic Jobs

Protectionism shields domestic industries from competition, helping to preserve local jobs. For example, the US automobile industry has benefited from protectionist policies that have kept foreign competitors at bay, thus maintaining jobs in manufacturing.

B. Prevention of Dumping

Protectionist measures prevent countries from "dumping" goods at below-cost prices to eliminate competition. The US has used anti-dumping tariffs on Chinese steel to prevent an oversupply of cheap steel.

C. National Security

Certain industries are crucial to a country’s national security, such as defense or energy. Protectionism can ensure that these sectors remain under domestic control. The US restricts the import of sensitive technologies from countries like China to protect national security interests.

D. Infant Industry Argument

Protectionism can help emerging industries grow and become competitive internationally. For instance, South Korea’s protectionist policies helped its automobile and electronics industries thrive in the global market.

5. Arguments Against Protectionism

A. Higher Prices for Consumers

Protectionism often leads to higher prices for consumers. US tariffs on Chinese electronics have raised the cost of products like smartphones and televisions, which harms consumers.

B. Reduced Economic Efficiency

Protectionism can lead to inefficiencies, as protected industries may lack the incentive to innovate or improve. Japan’s agricultural sector is an example, as it remains inefficient due to high protectionist tariffs.

C. Retaliation and Trade Wars

Protectionist policies can lead to retaliatory tariffs, escalating trade conflicts. The US-China trade war is a prime example of how protectionism can result in a cycle of tariffs that harm both economies.

D. Negative Impact on International Relations

Protectionism can strain diplomatic relations and hinder global cooperation. The EU’s agricultural protectionism has been a source of tension in trade talks with developing nations, leading to trade barriers in other sectors.

6. Conclusion

While protectionism can offer benefits such as protecting jobs and domestic industries, it also comes with significant downsides. It can lead to higher prices, inefficiencies, and trade conflicts. A balanced approach that considers both the advantages and disadvantages of protectionism is crucial for policymakers in a globalised economy.

7. Discussion Questions

How does protectionism help protect domestic industries?

What are the costs of protectionism for consumers?

How do tariffs impact global supply chains?

What role do government subsidies play in fostering domestic industries?

How can protectionism affect international trade relations?