Government intervention in Markets

Governments play a vital role in ensuring markets function effectively and fairly. When markets fail or social objectives need to be achieved, governments may intervene by implementing price controls or quotas. This chapter focuses on three key types of intervention: price floors, price ceilings, and quotas. Along the way, we’ll explore real-world examples and evaluate their effectiveness to help you better understand how these policies affect markets.

1. Taxes

Definition: A tax is a compulsory financial charge imposed by the government on goods, services, or income. Taxes on goods and services are usually aimed at discouraging consumption (e.g., excise taxes on cigarettes) or raising government revenue.

How It Works:

(direct tax) Imposed on income or wealth, directly paid to the government by a taxpayer. For example Personal Income Tax or Corporate Income Tax.

(indirect tax) Imposed on goods and services, collected by an intermediary on behalf of government. For example, Goods and Services Tax.

An indirect tax leads to increase in production costs for firms.

To maintain their profits, firms will increase the price of the good or service by the amount of tax by decreasing the quantity supplied at each price level.

This leads to higher prices for consumers and lower equilibrium quantities when the supply curve shifts leftwards and supply decreases.

Want to receive notes like these? Join our trial classes now!

Want to receive notes like these? Join our trial classes now!

How It Might Not Work:

There is a high possibility that the government will end up over-taxing or under-taxing.

Over-taxing will lead to an even larger deadweight loss incurred than before tax was imposed. (graph 1)

Under-taxing will not fully internalise the deadweight loss. (graph 2)

If demand is inelastic (e.g., addictive goods like tobacco), the tax might not significantly reduce consumption and a high tax is required which would strain government budget.

This incurs opportunity costs when government decided to use their scarce resources to tax instead of developing other sectors like healthcare of education.

Want to receive notes like these? Join our trial classes now!

Advantages:

Reduces consumption of demerit goods.

Raises government revenue to fund public goods or welfare programs.

Disadvantages:

Reduces consumer and producer surplus, creating deadweight loss.

Regressive taxes may disproportionately burden low-income groups.

Strain government budget.

Incur opportunity costs.

2. Subsidies

Definition: Subsidies are given by government to different economic agents to increase the supply and promote the consumption of merit good. Merit goods are goods deemed by government to be socially desirable but underconsumed.

How It Works:

(direct subsidy) Directly given to recipient from the government via an actual payment of funds. (graph 1)

(indirect subsidy) Provided through supporting the reduction of the price of a good or service via subsidising the production.

Subsidies lower production costs.

To maintain their profits, producers will decrease the price of the good or service by the amount of subsidy by increasing the quantity supplied at each price level.

This leads to an increase in supply and shifts the supply curve rightwards.

Consumers benefit from lower prices, while producers increase output and revenue.

Want to receive notes like these? Join our trial classes now!

How It Might Not Work:

Over-subsidizing can lead to inefficiencies and overproduction. (graph 2)

Firms may become reliant on subsidies and fail to innovate or cut costs.

Under-subsidising will defeat the purpose of imposing a subsidy in the first place as producers may not be incentivised enough to pass on their lower production costs as lower prices to consumers. (graph 3)

Hence, consumption of merit good may not increase to the socially optimal quantity.

Advantages:

Encourages consumption of merit goods (e.g., education, healthcare).

Reduces production costs, making goods more affordable.

Increased consumption of merit goods and promotion of economic equity.

Disadvantages:

High fiscal burden and potential market distortion.

May distort market efficiency if misallocated.

3. Price Controls

Price Ceiling (Maximum Price)

Definition: A legal maximum on the price at which a good can be sold.

How It Works:

When the price is set below equilibrium price Pe, quantity demanded for the good increases from Qe to Qdd and quantity supplied for the good decreases from Qe to Qss, resulting in a shortage of unit Qdd-Qss.

Shortage will persist as market is prevented from adjusting itself.

Total revenue will fall from 0PeE0Q0 to 0PcYQss.

How It Might Not Work:

More problematic as it leads to formation of black markets where prices are even higher than original Pe.

Unsatisfied buyers willing to pay higher prices to get limited goods.

Profits made by sellers.

The more demand price inelastic the good is, the more the profit made by sellers.

Advantages:

Ensure that firms with market dominance do not charge extremely high prices especially for necessities.

Protect interest of customers.

Prevent suppliers from exploiting consumers by charging exorbitant prices in times of shortage.

prevent/solve overconsumption.

Disadvantages:

Leads to shortage.

Shortage leads to long queues, long waiting times, which causes sellers to restrict or priorities sales to favoured customers(like those willing to pay higher prices).

This hurts low incomers and the policy which is aimed to make prices affordable for the low income groups would be deemed retardant.

Leads to deadweight loss.

Leads to formation of black markets.

Real-World Example: Energy Price Caps in Europe:

During the 2022 energy crisis, caused by the war in Ukraine and rising natural gas prices, many European governments imposed price ceilings to protect households from unaffordable energy costs. For instance, the UK introduced the Energy Price Guarantee, capping how much households could pay per unit of energy.

While the energy price caps protected millions of households from skyrocketing bills, they led to higher government spending and discouraged energy companies from making long-term investments in renewable energy.

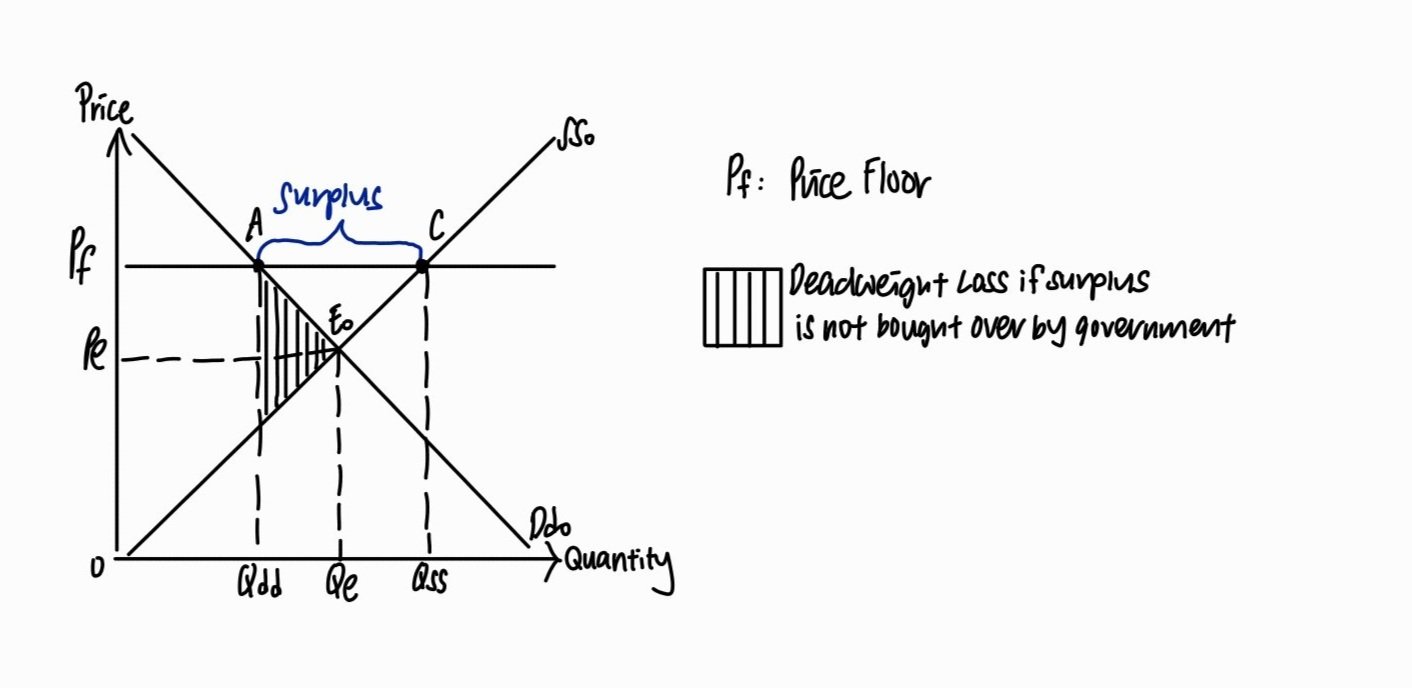

Price Floor (Minimum Price)

Definition: A legal minimum at which a good can be sold.

How It Works:

Protect income of low-income producers and ensure they receive a minimum wage for their goods.

Tackle price instability.

When price floor is set above equilibrium price Pe, quantity demanded of the good decreases from Qe to Qdd and quantity supplied of the good increased from Qe to Qss, resulting in the formation of a surplus of units Qdd-Qss.

Surplus persists as market is prevented from adjusting itself.

Misallocation and overallocation of resources shows there is inefficient allocation of resources.

The more price inelastic the demand is for the good, the higher the income earned by farmers.

Total revenue increases from 0PeE0Qe to 0PfCQss.

How It Might Not Work:

Surpluses may require government intervention (e.g., buying excess stock).

Can lead to unemployment in the case of high minimum wages.

Advantages:

Protects producers or workers from exploitation.

Stabilizes income for vulnerable groups.

Surplus bought over by government allows farmers to earn even higher profits.

Government may decide to keep stocks for availability of resources for times of emergency.

Disadvantages:

Leads to deadweight loss.

If government buys surplus, it will strain government budget due to costs of storage.

Lead to opportunity costs.

If government do not buy surplus, it will result in deadweight loss.

High prices from price floor may result in productive inefficiencies as producers use cheaper methods of production since Pf is not incentivised.

Real-World Example: Minimum Wage in the United States:

In 2023, several U.S. states raised their minimum wages to help workers cope with rising costs of living. For instance, California increased its minimum wage to $15.50/hour. This policy aimed to ensure workers could afford necessities like housing, food, and healthcare.

While the increase in minimum wages in California helped improve worker welfare, it also raised concerns about layoffs in industries with thin profit margins, such as retail and hospitality.

4. Quantity Controls (Quotas)

Definition: A legal restriction on the quantity of goods and services that can be produced/consumed in a particular time period.

How It Works:

Restrict consumption of socially undesirable goods and switch to domestically produced substitutes.

When government restrict quantity to Q1, price of goods increases from P0 to P1.

Consumers willing and able to pay at P1 for Q1, hence prices increases to P1 by producers.

How It Might Not Work:

Over-restricting supply may harm consumers and encourage black markets.

Producers may shift to alternative goods or markets.

Advantages:

Controls quantity.

More certain outcome.

Disadvantages:

Leads to deadweight loss.

Prices increase.

Reduces market efficiency and consumer surplus.

Administrative and enforcement expenses, reduced consumer welfare.

Real-World Example: OPEC+ Oil Production Quotas:

From 2021 to 2023, the Organization of Petroleum Exporting Countries (OPEC+) implemented production quotas to stabilize oil prices. In 2022, OPEC+ announced a 2 million barrels-per-day cut in oil production to counter falling prices caused by slowing global demand.

The OPEC+ quotas benefited oil-exporting nations by supporting their revenues, but they also fueled inflation worldwide as energy costs soared.

5. Direct Provision

Definition: The government directly supplies goods and services, often public or merit goods.

How It Works:

Ensures access to essential services where the market fails to provide adequately (e.g., healthcare, education).

How It Might Not Work:

High costs may strain government budgets.

Inefficiency due to lack of competition.

Advantages:

Assuming that government has total control over supply of goods, they can provide the good up to socially optimal level.

More certain outcome.

Guarantees provision of essential services.

Promotes equity by addressing affordability issues.

Disadvantages:

High fiscal burden.

Risk of inefficiency and mismanagement as government lack profit motive and are less experienced in production compared to private firms.

6. Joint Provision

Definition: Collaboration between the government and private sector to provide goods or services.

How It Works:

Combines public funding with private expertise to deliver efficient and cost-effective solutions.

How It Might Not Work:

Conflicting priorities between profit-driven private firms and public welfare goals.

Advantages:

Improves efficiency and innovation.

Reduces government expenditure.

Cost-effective service delivery and resource optimization.

Provide quality services to public whilst maintaining affordability.

Profit objective of private firms encourage greater efficiency and innovation.

Risk sharing.

Disadvantages:

Complex nature of PPPs (public private partnership).

7. Education Campaigns

Definition: Efforts to inform and educate consumers or producers about the benefits or harms of certain goods or behaviors.

How It Works:

Influences demand by changing preferences (e.g., anti-smoking campaigns, renewable energy promotions).

How It Might Not Work:

Consumers may ignore messages or be resistant to change.

Effectiveness depends on the extent of outreach.

Advantages:

Promotes informed decision-making.

Encourages long-term behavioral changes.

Disadvantages:

Results may take time to materialize.

Costly to design and execute large-scale campaigns.