Fiscal Policy

Fiscal policy is one of the key tools that governments use to manage their economies. By adjusting government spending and taxation, fiscal policy can influence economic activity, employment, inflation, and growth. In this chapter, we will explore how fiscal policy works, the different types of fiscal policies, and how they can impact living standards and overall economic stability. We will also look at real-world examples and evaluate the limitations and challenges governments face when using fiscal policy.

1. Introduction to Fiscal Policy

What is Fiscal Policy?

Fiscal policy refers to the decisions made by governments regarding how much they spend and how much they tax. These decisions influence the overall health of the economy, aiming to achieve objectives such as economic growth, low unemployment, and controlled inflation. Fiscal policy is often used alongside monetary policy (managed by central banks) to stabilize the economy.

Key Objectives of Fiscal Policy

Fiscal policy relies on two main tools:

Government Expenditure (G): This refers to all government spending on infrastructure, social programs, public services, and salaries for government employees. Higher G injects money into the economy, while lower G reduces circulating money.

Taxation (T): Taxes are levied on income, consumption, and other activities to generate revenue for the government. Lower T leaves more disposable income with consumers and businesses, while higher T reduces it.

Governments use fiscal policy to achieve the following goals:

Economic Growth: By stimulating demand and investment, governments can boost the economy.

Reducing Unemployment: Fiscal policy can create jobs through government spending.

Controlling Inflation: By regulating demand, fiscal policy helps keep prices stable.

Stabilizing the Economy: Governments use fiscal policy to smooth out the business cycle, reducing the impacts of recessions or periods of rapid economic growth.

Real-World Example

During the 2008 Global Financial Crisis, governments across the world used fiscal policy to stimulate their economies. The United States introduced a large-scale stimulus package to increase government spending and cut taxes, helping to mitigate the effects of the recession.

2. Types of Fiscal Policy

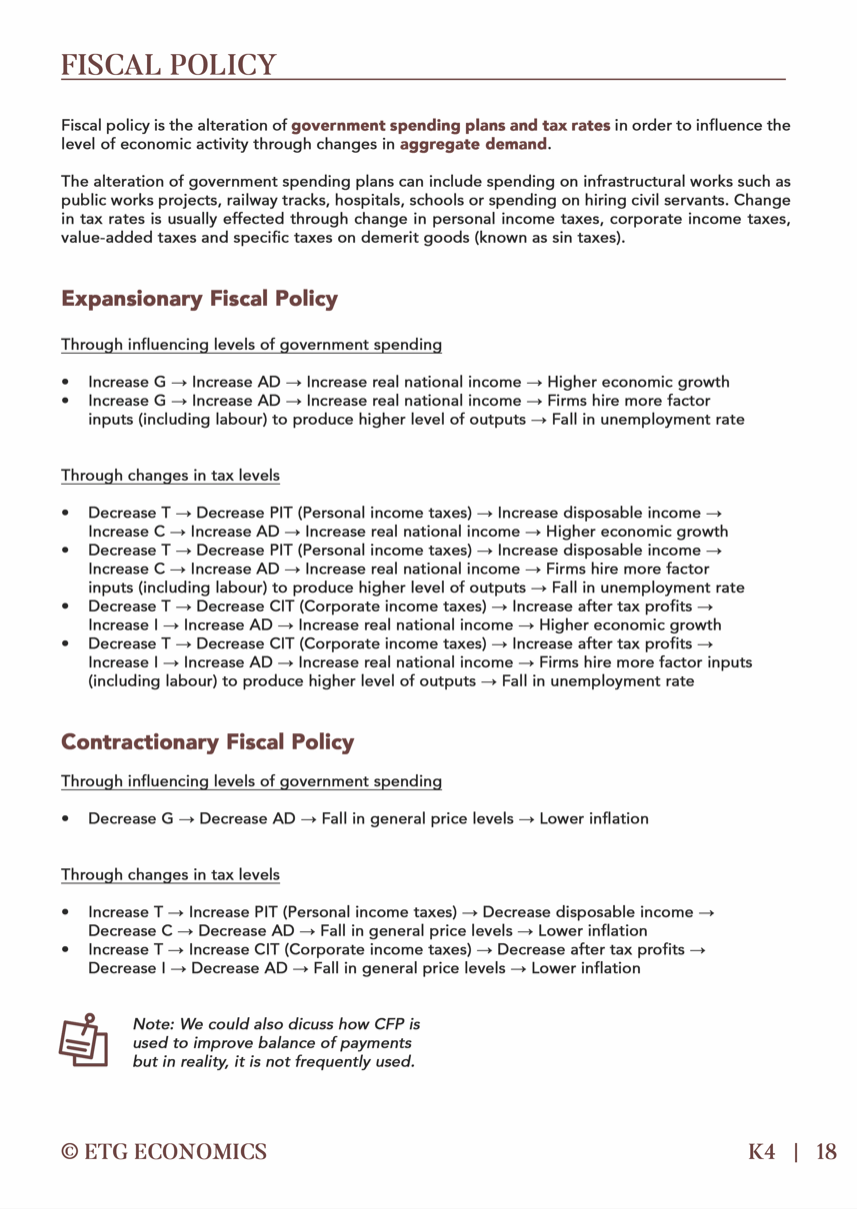

Expansionary Fiscal Policy

This type of fiscal policy is used when the economy is struggling, such as during a recession. It involves increasing government spending or reducing taxes to stimulate economic activity. The idea is to boost demand and investment, helping to reduce unemployment and increase economic growth.

Real-World Example

In response to the COVID-19 pandemic, countries like Australia and Singapore introduced expansionary fiscal policies. Singapore implemented the Resilience Budget to support businesses and individuals, ensuring that the economy remained stable during lockdown periods.

Contractionary Fiscal Policy

Contractionary fiscal policy is used when the economy is overheating, causing inflation to rise. It involves reducing government spending or increasing taxes to slow down economic activity. This helps reduce demand and control inflation.

Real-World Example

In the United States, the government has occasionally increased taxes or reduced spending to cool down the economy during periods of excessive growth, especially when inflation rises too quickly.

3. Discretionary Fiscal Policy: Tax Changes vs. Government Expenditure

Discretionary Fiscal Policy

Discretionary fiscal policy refers to the deliberate changes in government spending or taxation to influence the economy. This is in contrast to automatic stabilizers like unemployment benefits, which automatically adjust without government action.

Tax Changes

Tax Cuts: Reducing taxes increases disposable income for individuals and businesses. This encourages people to spend more and businesses to invest more, stimulating economic activity.

Real-World Example

The Tax Cuts and Jobs Act of 2017 in the United States reduced corporate and individual tax rates, hoping to boost consumer spending and business investment.

Tax Hikes: Increasing taxes helps to reduce demand in the economy. This can be used to cool down inflation during periods of excessive economic growth.

Government Expenditure

Increasing Government Spending: This directly stimulates the economy by funding projects like infrastructure, healthcare, and education, which create jobs and drive demand in the economy.

Real-World Example

China's Belt and Road Initiative is an example of using government spending to stimulate economic growth and increase trade connections globally.

Comparison:

Tax cuts usually have a quicker effect by putting more money in the hands of consumers and businesses.

Government spending, especially on infrastructure, can have longer-lasting effects, boosting productivity and creating jobs.

Impact on Aggregate Demand

Fiscal policy influences economic activity by affecting Aggregate Demand (AD).

Expansionary Fiscal Policy: Aims to increase AD during recessions or periods of low growth.

Increased G:

Direct spending on infrastructure projects or public services creates jobs and boosts demand for related goods and services.

Transfer payments like unemployment benefits put money directly into consumers' pockets, increasing consumption spending.

Decreased T: Lower taxes leave consumers and businesses with more disposable income, encouraging them to spend and invest more. This is called the multiplier effect as the initial increase in spending ripples through the economy, generating further economic activity.

Contractionary Fiscal Policy: Aims to decrease economic activity (reduce inflationary pressures).

Decreased G: Lower government spending reduces money circulating in the economy, dampening demand for goods and services.

Increased T: Higher taxes reduce disposable income, leading to lower consumption and investment spending.

Impact on Living Standards

Fiscal policy can significantly affect living standards:

Economic Growth: Expansionary policy can promote economic growth, potentially leading to higher incomes and improved living standards. However, excessive deficits can hinder long-term growth due to rising interest rates and crowding-out effects (discussed later).

Income Distribution: Fiscal policy can be used to achieve a more equitable income distribution.

Progressive Taxation: This system taxes higher incomes at a greater rate than lower incomes, generating revenue to fund social programs and transfers that support lower-income individuals.

Targeted Transfers: These are direct payments to specific groups facing hardship, such as unemployment benefits or childcare subsidies.

Public Goods and Services: Government spending on public goods like education, healthcare, and infrastructure can improve quality of life, health outcomes, and economic opportunities in the long run.

4. Maintaining Fiscal Sustainability Over the Long Term

What is Fiscal Sustainability?

Fiscal sustainability means that a government can manage its budget in a way that does not lead to excessive debt accumulation. A sustainable fiscal policy ensures that future generations will not face unfair economic burdens through higher taxes or cuts in government services.

Why is Fiscal Sustainability Important?

If a government borrows too much, it may face difficulties in repaying debt, leading to higher taxes or reduced government spending in the future. Maintaining fiscal sustainability helps prevent this issue and ensures long-term economic stability.

Real-World Example

Singapore is often cited as a model for fiscal sustainability. The Singapore government runs a balanced budget and keeps public debt levels low, ensuring the economy remains stable over the long term.

5. Limitations of Fiscal Policy

Crowding Out

Crowding out happens when increased government spending raises interest rates, making it more expensive for businesses to borrow money. This can reduce private investment, as businesses might find it harder to obtain financing for their projects.

Real-World Example

In the United States, concerns about crowding out have arisen when the government increases spending significantly, leading to higher public debt and higher interest rates that can negatively affect private investment.

Time Lags

Fiscal policies can take time to implement and show results. The lag between identifying an economic problem and implementing fiscal measures, as well as the time it takes for these measures to have an impact, can make fiscal policy less effective.

Real-World Example

During the 2008 financial crisis, stimulus packages were introduced, but the economic recovery took years to fully materialize due to the time lag in policy implementation.

Political Constraints

Political factors can influence fiscal policy decisions. Governments may delay or alter fiscal measures due to political pressures, making it harder to implement effective policies when needed.

6. Prudent Fiscal Policy in Singapore

Why Singapore cannot undergo fiscal policy and what is its policy stance instead:

First, the Singapore economy is extremely open and heavily reliant on imports. This limits the scope for counter-cyclical fiscal policy, as a large part of any fiscal stimulus would be “leaked out” through increased imports. Singapore’s public spending—at less than a fifth of Gross Domestic Product (GDP)—is also very low by the standards of most developed economies. This suggests that pumppriming measures aimed at increasing aggregate demand when growth is below potential are likely to be of limited effectiveness. Rather than employing Keynesian measures of lower taxes or higher public spending to deal with negative shocks, the government has tended to rely more on direct cost-cutting measures, especially in the form of lowering employers’ contribution rates to the Central Provident Fund (CPF), Singapore’s fully-funded social security system. The government also puts medium-term considerations of growth and economic competitiveness above any demand management objectives. For instance, when the government cut corporate and personal income taxes and increased the goods and services tax (GST) during the slow-growth years of the early 2000s, its primary objective was to improve supply side conditions and promote growth over the medium-term.

Fiscal Prudence in Singapore

Singapore has gained a reputation for maintaining fiscal prudence. The government typically runs a balanced budget and ensures low public debt levels, even in times of economic crisis. This careful management has helped Singapore maintain long-term stability.

Real-World Example

During the COVID-19 pandemic, Singapore introduced fiscal measures such as the Resilience Budget, while also maintaining its commitment to long-term fiscal sustainability.

Considerations for Singapore

Singapore's unique economic structure requires careful consideration when implementing fiscal policy:

Small Open Economy: Singapore is heavily reliant on international trade. Expansionary policies could lead to inflation if imports rise faster than domestic production. The Monetary Authority of Singapore (MAS) may need to counteract this through monetary policy adjustments.

Long-Term Sustainability: Maintaining a balanced budget or a small surplus helps ensure long-term fiscal sustainability. Excessive government debt can limit future spending flexibility and crowd out private investment.

Automatic Stabilizers: Some government programs act as automatic stabilizers, helping to moderate economic fluctuations. For example, unemployment benefits automatically increase during economic downturns, providing support to individuals and maintaining some level of consumer spending.

7. Consequences of Budget Deficits vs. Benefits of Budget Surpluses

Budget Deficits

A budget deficit occurs when government spending exceeds its revenue. While deficit spending can stimulate economic activity in the short term, it can lead to higher public debt, which may burden future generations through higher taxes or reduced public services.

Real-World Example

The United States has had persistent budget deficits, raising concerns about the sustainability of its growing national debt.

Budget Surpluses

A budget surplus occurs when a government’s revenue exceeds its spending. Surpluses can be used to pay off public debt, build reserves, or reduce taxes.

Real-World Example

Singapore often runs budget surpluses, which it uses to strengthen its fiscal reserves and maintain its credit ratings.

8. Conclusion

Fiscal policy is a vital tool for managing a nation’s economy. By adjusting government spending and taxes, policymakers can influence economic growth, employment, inflation, and living standards. However, fiscal policy has limitations, such as time lags, crowding out, and political factors. Ensuring fiscal sustainability is crucial for long-term stability, and countries like Singapore provide an example of how prudent fiscal policies can support both short-term recovery and long-term economic health.

9. Discussion Questions

How does discretionary fiscal policy differ from automatic stabilizers?

What are the advantages and disadvantages of using government spending versus tax cuts to stimulate the economy?

Discuss the potential consequences of running large budget deficits in both the short and long term.

How do time lags affect the effectiveness of fiscal policy?

Why is fiscal sustainability important, and how can governments ensure it?

If you're looking for high-quality economics tuition Singapore, look no further than ETG Economics Tuition. Led by Mr. Eugene Toh, a distinguished tutor with double Master's degrees and featured in various media outlets, ETG provides specialized programs for A Level Economics and IB Economics students. Whether you're preparing for H2 Economics or H1 Economics, ETG offers a comprehensive curriculum that includes in-house materials such as textbooks, summaries, and essay banks, all designed to ensure that students are well-prepared for exams. With a strong track record of success, 71% of ETG's A Level students achieved an 'A' grade in 2023, with over 90% from top junior colleges like RI, HCI, and NJC. Explore more about the program and the results at ETG, and see why we are considered a top economics tuition provider in Singapore.

ETG also offers flexible learning options to suit the busy schedules of students. You can attend classes at various locations including Bukit Timah, Marymount, and Bedok, or opt for online economics tuition via Zoom, ensuring you can learn from the comfort of your home. With a range of personalized services, including consultation sessions with Mr. Toh and a comprehensive graded homework program, ETG stands out as a leading economics tuition centre in Singapore. You can even access recorded lessons online, making it easy to revise at your convenience. Register today for ETG classes or attend a trial lesson to see how we can help you excel in your economics studies.

Take a look at our stunningly curated textbooks, exclusively available for ETG students only: