Examine how successful the Singapore government might be in addressing the economic challenges caused by export restrictions from abroad.

In recent times, numerous countries have imposed export restrictions on food items like grains and meat. Such export bans can lead to sharp increases in prices, posing potential threats to Singapore’s economy.

b.Examine how successful the Singapore government might be in addressing the economic challenges caused by export restrictions from abroad. [15]

Introduction

Export restrictions on essential food items and raw materials—such as grains, meat, and oil—have increasingly become a tool used by countries to shield their domestic markets from supply shortages and rising prices. However, for small, highly open economies like Singapore, such export bans pose serious challenges. With virtually no domestic agricultural or natural resource base, Singapore relies heavily on imports for food, fuel, and industrial inputs. These restrictions can therefore raise both imported and cost-push inflation, disrupting Singapore’s price stability and broader economic performance. The Singapore government has several tools at its disposal to mitigate these risks, but the extent of its success is constrained by structural limitations and the nature of the global economy.

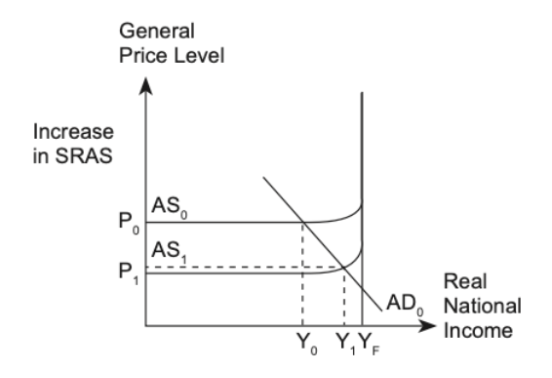

The key economic challenge posed by export bans is inflation—both imported and cost-push in nature. When foreign countries restrict exports of food or energy products, global supply shrinks. This reduction in global supply raises international prices, and Singapore, as a price-taker, must pay more for the same goods. The cost of imported necessities like food, fuel, and raw materials rises. Firms that rely on these inputs face higher production costs, resulting in a leftward shift of the Short-Run Aggregate Supply (SRAS) curve from AS₀ to AS₁. As a result, general price levels increase from P₀ to P₁, causing cost-push inflation. This inflation reduces the real purchasing power of consumers, lowers firms’ profit margins, and may dampen economic growth if left unmanaged.

Modest and Gradual Appreciation of the SGD

One strategy the Monetary Authority of Singapore (MAS) uses to tackle imported inflation is managing the Singapore dollar’s nominal effective exchange rate (S$NEER) through its exchange rate-centred monetary policy. By allowing for a modest and gradual appreciation of the SGD, MAS strengthens the local currency against a basket of foreign currencies. A stronger SGD reduces the cost of imported goods, thus mitigating imported inflation.

Additionally, cheaper imports lower firms’ production costs, causing a rightward shift in SRAS from AS₁ back towards AS₀, easing inflationary pressures. In effect, this dampens the inflationary impact of export bans abroad. However, Singapore’s appreciation is always modest and gradual. This is because an overly strong currency would reduce export competitiveness by making Singapore’s goods and services more expensive to foreign buyers, thereby decreasing (X-M), lowering Aggregate Demand (AD), and potentially weakening real GDP growth and employment. Hence, while this policy helps moderate inflation, it cannot completely offset large price surges caused by severe or widespread export bans.

Supply-Side Policy - Diversification of Import Sources

Singapore also adopts supply-side strategies to address vulnerabilities to export bans. A cornerstone of this strategy is diversification—ensuring that no essential good is sourced from a single country. This policy reduces exposure to sudden trade disruptions. For instance, when Malaysia imposed a temporary export ban on fresh chicken in 2022, Singapore quickly pivoted to import chicken from alternative sources such as Thailand, Indonesia, and Australia. This increase in alternative supply helped ease domestic price pressures by shifting the supply curve of chicken rightward, reducing the impact on equilibrium price and quantity.

Such diversification requires forward planning, including the establishment of bilateral trade agreements, rigorous food safety protocols, and investment in logistical infrastructure. Singapore’s longstanding focus on food security—evident in agencies such as the Singapore Food Agency (SFA) and initiatives like “30 by 30” (to produce 30% of Singapore’s nutritional needs locally by 2030)—illustrates the proactive steps being taken to enhance resilience against external food supply shocks.

Evaluative Conclusion

Despite these policies, Singapore cannot fully insulate itself from the effects of global export bans. First, its reliance on global trade—especially for fuel and food—makes it extremely vulnerable to supply-side shocks. In the case of energy, Singapore is a net importer and a price-taker on global markets. It cannot influence global oil prices and is deeply affected by geopolitical events. For example, while sanctions on Russian oil were not explicit export bans, their impact on global energy prices mirrored that of a supply shock. Higher energy prices cascade through the economy, raising transport, electricity, and production costs—driving inflation.

Second, as mentioned earlier, the MAS cannot afford to allow an unchecked appreciation of the SGD. Doing so would harm exports, worsen the balance of trade, and cause job losses in trade-exposed sectors. Thus, Singapore's ability to use exchange rate policy as a tool is necessarily restrained.

Finally, while diversifying sources of imports improves resilience, it often comes at higher cost. Alternative suppliers may be further away or more expensive, increasing transport and compliance costs. These costs may still result in higher domestic prices, albeit less extreme than in the absence of diversification.

In summary, Singapore is relatively well-placed—compared to many other small economies—to manage the risks posed by foreign export bans. Its dual-pronged approach of using monetary policy to appreciate the SGD and diversifying import sources is sound and has proven effective in cushioning the economy from severe inflationary shocks. However, these policies are not without limitations. Structural constraints—such as a reliance on imports and the risk of harming export competitiveness—mean that the government can only moderate, not eliminate, the impact of export restrictions from abroad. Ultimately, Singapore’s success in managing these risks hinges on its ability to strike a delicate balance between price stability, supply resilience, and economic growth.

📚 ETG Weekly Economics Programme — The Proven Path from ‘U’ to ‘A’

✨ Model essays are great. But imagine writing your own — distinction-ready, L3-evaluative, and under exam pressure.

That’s exactly what we train students to do at Economics at Tuitiongenius (ETG) — Singapore’s most trusted economics tuition centre. Whether you're in JC1 or JC2, our A Level Economics tuition programme delivers the content mastery, writing skills, and feedback system you need to level up fast.

🎯 Why Our Weekly Classes Work

Led by Mr Eugene Toh, one of Singapore’s top economics tutors, ETG’s structured weekly lessons go beyond school lectures — offering a complete ecosystem of support, strategy, and success.

✅ What You’ll Get:

Weekly Lessons with Essay & CSQ Drills

Graded Homework with Personalised Feedback

Full Access to 160+ On-Demand Video Lessons

Hardcopy Textbooks + Model Essays & Summaries Delivered Each Term

24/7 WhatsApp Support & Consults with Mr Toh

Attend Onsite (Coronation, Bedok, etc.), Live on Zoom, or Learn Online at Your Pace

💬 “I started with an E and ended with an A. The weekly feedback and structured learning just worked.”

– ETG Student, Class of 2023

💡 Ideal For:

JC1 students looking to build strong foundations before Promos

JC2 students preparing for Prelims and A Levels

Anyone searching for JC economics tuition or H2 economics tuition that delivers consistent results

🔗 Register now at tuitiongenius.com/etgclasses

📲 Or WhatsApp us at 8168 3986 — we’ll answer your questions and get you started within 24 hours

It’s not just tuition. It’s your weekly upgrade in clarity, confidence, and grades.

Let’s turn your potential into performance — together.