(2014) A Level H2 Econs Essay Q4 Suggested Answer by Mr Eugene Toh (A Level Economics Tutor)

(2014) A Level H2 Econs Paper 2 Essay Q4

Disclaimer: The answers provided on our website is a 'first draft outline’ version of the answers provided for your convenience.

For the full, finalised answers, please click here to purchase a hard copy of the Comprehensive TYS Answers authored by Mr Eugene Toh and published by SAP. (The page might take awhile to load)

Search for “COMPREHENSIVE ANSWERS TO A LEVEL H2 ECONOMICS YEARLY EDITION” or “9789813428676” to purchase.

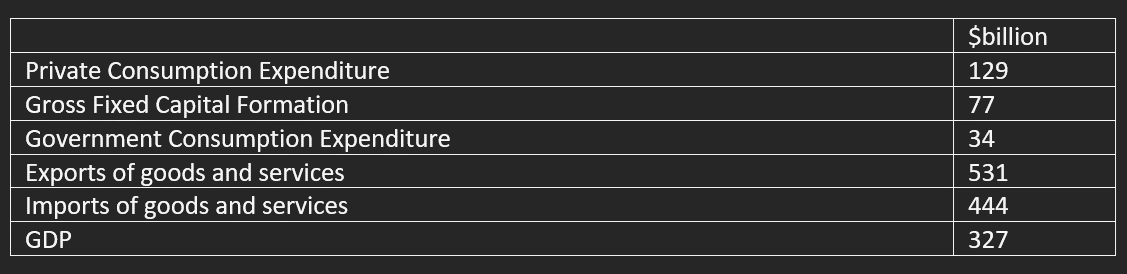

4. The following table relate to the Singapore economy in 2011.

Source: http://www.singstat.gov.sg/stats/latestdata.html, accessed 30 January 2013

(a) Economies consist of several key sectors such as households, firms, government and the rest of the world. Explain the relative importance of these key sectors of the circular flow of income in determining the national income in Singapore. [10]

The circular flow of income / how injections & withdrawals determine national income

As seen in Figure 1 above, Households provide firms with Consumption expenditure, and in return, firms provide households (workers) with income.

Interactions that sectors have with the circular flow of income can be broadly classified as injections and withdrawals

For the government sector, the government provides an injection via government spending while withdrawals from the circular flow by the government come in the form of taxation

For the ‘rest of the world’/’overseas’ sector, the rest of the world provides an injection via export earnings while withdrawals occur through Import expenditure when locals purchases imports

An initial injection into the circular flow will via the multiplier effect cause a multiplied increase in real national income.

Relative importance of the sectors

While private consumption was $129 billion in 2011- the Household sector is likely the least important sector contributing to national income considering

Singapore has a small domestic market and

It has no natural resources & imports most of its necessities, there are high leakages since the consumption of most consumer goods are likely to be imported goods

The “Rest of the World” sector is likely the most important sector contributing to national income given that Singapore is highly dependent on trade for economic growth. Net exports (X-M) was $531b - $444b = $87 billion in 2011

The next most important sector after the “Rest of the World” would likely be “Firms”. Investment expenditure is one of the two twin engines of growth for Singapore.

The “Government” sector is likely to be small in contributing to national income given the government’s stance on prudence and preventing crowding out of private investments.

(b) Discuss the likely effects of Singapore’s national income and its components when its exchange rate appreciates. [15]

Impacts of an appreciation on the different components of national income

When the SGD appreciates, it can result in imported consumer goods becoming cheaper → increase in purchasing power → increase Consumption

Import expenditure will increase by a similar extent

An appreciation of the SGD can have different effects on Investment expenditure

Stronger SGD can make purchasing imported inputs more expensive / makes exports more expensive and thus difficult to sell → reducing profitability → discouraging firms from increasing Investments

A stronger SGD over an extended period of time however, signifies a healthy and growing economy → attract investors to invest → increase Investment

An appreciation of the SGD can make exports more expensive to sell, and imports cheaper for locals to purchase

Exports fall while imports rise

(X-M) decrease

Impacts of an appreciation on national income

An exchange rate appreciation in the context of Singapore will likely follow the path of a modest and gradual appreciation given that MAS carries out an exchange rate based monetary policy with a usual stance of ensuring a modest and gradual appreciation of the SGD

When the exchange rates appreciates, it should cause an increase in import expenditure as imports become cheaper while exports revenue should fall as exports become more expensive to foreigners with a stronger SGD.

(X-M) should fall → Fall in AD → Fall in real national income via multiplier

However, in Singapore’s case, the following factors would modify the impact of an an appreciation of the SGD

In Singapore’s case, a modest and gradual appreciation occurs instead of an outright significant appreciation of the SGD.

As a long-term ongoing strategy of implementing supply side policies such as increasing productivity to boost export competitiveness, it is likely that over time, Singapore’s exports should see either an improve in cost competitiveness and/or quality, thus helping to mitigate the impact of a loss in export competitiveness if given sufficient time - which is the point of a modest and gradual appreciation (it’s small and slow enough!)Also, since many of Singapore’s exports are produced using imported inputs, a stronger SGD also lowers the prices of imported inputs used in the production of such exports. This can also similarly help to mitigate the fall in export competitiveness

Taken as a collective → an appreciation of the SGD should not have a negative impact on Singapore’s national income, if anything at all, it should be a mild positive impact.

Found our TYS answers useful?

Maximise your A-Level H2 Economics preparation with the ETG A-Level H2 Economics TYS Crashcourse! Perfect for students looking to enhance their skills in both essay and case study analysis, this comprehensive 3-day crashcourse will cover over 60 essay questions and 20 case studies from the A-Level Economics Ten-Year Series. Whether you're attending onsite or via Zoom, our experienced tutors will guide you through the intricate demands of H2 Economics, offering expert feedback and graded answers. For the best economics tuition in Singapore, sign up now to secure one of the limited onsite seats!