(2021) A Level H2 Econs Essay Q2 Suggested Answer by Mr Eugene Toh (A Level Economics Tutor)

(2021) A Level H2 Econs Paper 2 Essay Q2

Disclaimer: The answers provided on our website is a 'first draft outline’ version of the answers provided for your convenience.

For the full, finalised answers, please click here to purchase a hard copy of the Comprehensive TYS Answers authored by Mr Eugene Toh and published by SAP. (The page might take awhile to load)

Search for “COMPREHENSIVE ANSWERS TO A LEVEL H2 ECONOMICS YEARLY EDITION” or “9789813428676” to purchase.

2. In recent years the United States (US) government has increased tariffs (import taxes) on a wide range of imported goods from China.

(a) With the aid of a diagram, explain what is meant by consumer surplus and producer surplus. [10]

Explain consumer surplus

Consumer surplus is the difference between the maximum price that consumers are willing to pay and the price that the consumers actually pay.

Consumers’ preferences are represented by the demand curve represented on Figure 1 as DD0 which is downward sloping indicating that more consumers are willing to buy a good as price decreases. At the same time, this also represents that there are a range of consumers who are willing to pay varying prices for the same good.

With reference to Figure 1 below, the market equilibrium price will be at Pe while the market equilibrium output will be at Qe given that market equilibrium is achieved when demand = supply.

Consumer surplus is represented on Figure 1 as PeE0P1 which is the area above the (transacted) price, bounded by the demand curve and (transacted) output.

Essentially, there are consumers who would have been willing to have paid a higher price for the good, but eventually since the market equilibrium price was lower than what the price they would have paid, these consumers have gained satisfaction, or otherwise termed “consumer surplus”

Explain producer surplus

Producer surplus is the difference between the minimum price that producers are willing to sell and the price that the producers actually sell at.

Producers willingness to sell is represented by the supply curve represented on Figure 1 as SS0 which is upward sloping indicating that more producers are willing to sell as prices increases. At the same time, this also represents a range of producers who are willing to sell at varying prices for the same good.

With reference to Figure 1 below, the market equilibrium price will be at Pe while the market equilibrium output will be at Qe given that market equilibrium is achieved when demand = supply.

Producer surplus is represented on Figure 1 as PeE00 which is the area below the (transacted) price, bounded by the supply curve and (transacted) output.

Essentially, there are producers who would have been willing to have sold at a lower price for the good, but eventually since the market equilibrium price was higher than what the price they would have sold for, these producers have gained satisfaction, or otherwise termed “producer surplus”

(b) Discuss the view that all economic agents in the US economy will lose from the introduction of tariffs on imported goods from China. [15]

Explain using the tariff diagram

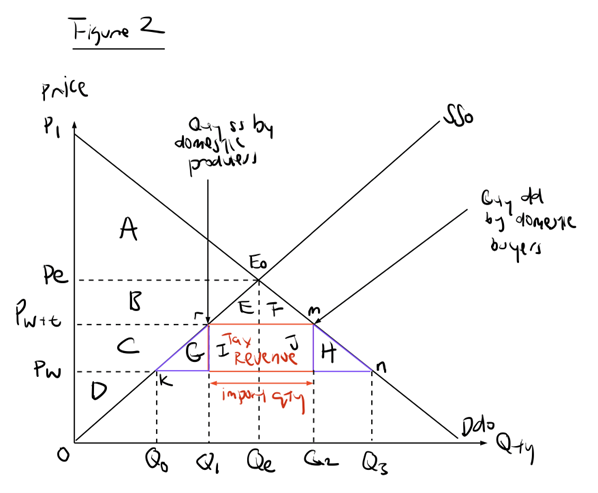

If a country doesn’t trade, the equilibrium price and output will be determined by the intersection of domestic demand DD0 and domestic supply SS0 at Pe & Qe.

The consumer surplus would be PeE0P1 (A) while producer surplus would have been at PeE00 (B).

But countries do trade, assuming the world price (the price that suppliers from the rest of the world supplies at) is Pw - consumers will consume at Q3 while domestic producers will supply only up till Q0. Consumers will import the quantity Q0Q3 from world producers. The consumer surplus would be PwnP1 (A+B+C+E+F+G+H+I+J) while (domestic) producer surplus would be Pwk0 (D).

Impacts of a tariff on consumers

A tariff will raise price for consumers from Pw to Pw+t and the consumer surplus will fall to Pw+tmP1 (A+B+E+F)

Consumers will also reduce their quantity demanded from Q3 to Q2.

Impacts of a tariff on domestic producers

A tariff will allow domestic producers to sell at a higher price at Pw+t and the producer surplus thus increases to Pw+tr0 (C+D)

Domestic producers will now increase their quantity supplied from Q0 to Q1.

Impacts of a tariff on the government

At Pw+t - domestic producers supply only up to Q1, while consumers will demand for up to Q2, the difference which is quantity Q1Q2 will be supplied by world producers.

Q1Q2 is thus the import quantity, which is levied a tariff t and thus the tax revenue derived will be Q1Q2 x t (I+J)

Society in general, loses

A deadweight loss (G+H) is generated as a result of the tariff

Threat of retaliation

As U.S. imposes tariffs on imported goods from China, it would invite retaliation from China, causing similar tariffs to be imposed by China on goods produced by the U.S.

Prices of imports from US would increase in China, causing demand for US exports to fall.

(X-M) falls → fall in AD → fall in real NY → lower economic growth → fall in incomes of consumers

(X-M) falls → balance of trade for US worsens → current account for US worsens

Not all producers gain

Based on Figure 2, in theory - US producers should gain a producer surplus from the tariff

This is however only applicable to the domestic producers producing goods where US has levied a tariff on

In recent years, there have been tariffs imposed on Chinese producers on goods such as steel, causing car-manufacturers in the U.S. to experience a higher cost of production - this causes prices to go up and lead them to become less competitive

Also, local firms may just buy goods from other countries which are more competitively priced as compared to buying from US firms still.

Conclusion

Consumers in the US economy lose in general from having to pay higher prices

Not all producers gain, some loses

The government gets to collect more tax revenues

Found our TYS answers useful?

Maximise your A-Level H2 Economics preparation with the ETG A-Level H2 Economics TYS Crashcourse! Perfect for students looking to enhance their skills in both essay and case study analysis, this comprehensive 3-day crashcourse will cover over 60 essay questions and 20 case studies from the A-Level Economics Ten-Year Series. Whether you're attending onsite or via Zoom, our experienced tutors will guide you through the intricate demands of H2 Economics, offering expert feedback and graded answers. For the best economics tuition in Singapore, sign up now to secure one of the limited onsite seats!